How Top 30 Forex Brokers can Save You Time, Stress, and Money.

How Top 30 Forex Brokers can Save You Time, Stress, and Money.

Blog Article

Little Known Questions About Top 30 Forex Brokers.

Table of ContentsWhat Does Top 30 Forex Brokers Do?The Ultimate Guide To Top 30 Forex BrokersThe Definitive Guide to Top 30 Forex BrokersGetting My Top 30 Forex Brokers To WorkAll About Top 30 Forex BrokersThe 9-Minute Rule for Top 30 Forex BrokersFacts About Top 30 Forex Brokers RevealedThe Best Strategy To Use For Top 30 Forex Brokers

Each bar chart represents one day of trading and includes the opening price, highest rate, lowest rate, and closing rate (OHLC) for a trade. A dash on the left stands for the day's opening price, and a comparable one on the right represents the closing rate.Bar charts for money trading aid traders recognize whether it is a customer's or vendor's market. The top portion of a candle light is made use of for the opening cost and highest cost point of a money, while the reduced section indicates the closing cost and lowest price factor.

Top 30 Forex Brokers - Questions

The developments and shapes in candlestick graphes are utilized to identify market direction and motion. A few of the a lot more usual developments for candlestick charts are hanging male - https://www.tumblr.com/top30forexbs/739215262616895488/our-mission-is-to-provide-the-best-trading?source=share and shooting star. Pros Largest in terms of everyday trading volume on the planet Traded 24-hour a day, five and a fifty percent days a week Starting funding can rapidly multiply Usually complies with the same policies as regular trading Much more decentralized than traditional supply or bond markets Tricks Leverage can make foreign exchange professions really volatile Take advantage of in the series of 50:1 is usual Requires an understanding of economic fundamentals and signs Less law than other markets No earnings creating tools Forex markets are the largest in regards to everyday trading quantity globally and consequently use one of the most liquidity.

Banks, brokers, and dealers in the forex markets allow a high quantity of leverage, indicating investors can control big settings with relatively little money. Take advantage of in the array of 50:1 is typical in foreign exchange, though also better quantities of leverage are readily available from specific brokers. Utilize should be utilized cautiously since several unskilled investors have actually endured significant losses making use of more take advantage of than was essential or prudent.

Top 30 Forex Brokers for Dummies

A currency investor requires to have a big-picture understanding of the economies of the different countries and their interconnectedness to understand the fundamentals that drive currency worths. The decentralized nature of foreign exchange markets implies it is much less regulated than other financial markets. The extent and nature of guideline in foreign exchange markets depend upon the trading territory.

The volatility of a certain money is a feature of multiple factors, such as the politics and business economics of its country. Events like economic instability in the form of a payment default or imbalance in trading relationships with one more money can result in considerable volatility.

The Greatest Guide To Top 30 Forex Brokers

Currencies with high liquidity have an all set market and show smooth and foreseeable price activity Recommended Reading in feedback to outside occasions. The United state buck is the most traded currency in the world.

All About Top 30 Forex Brokers

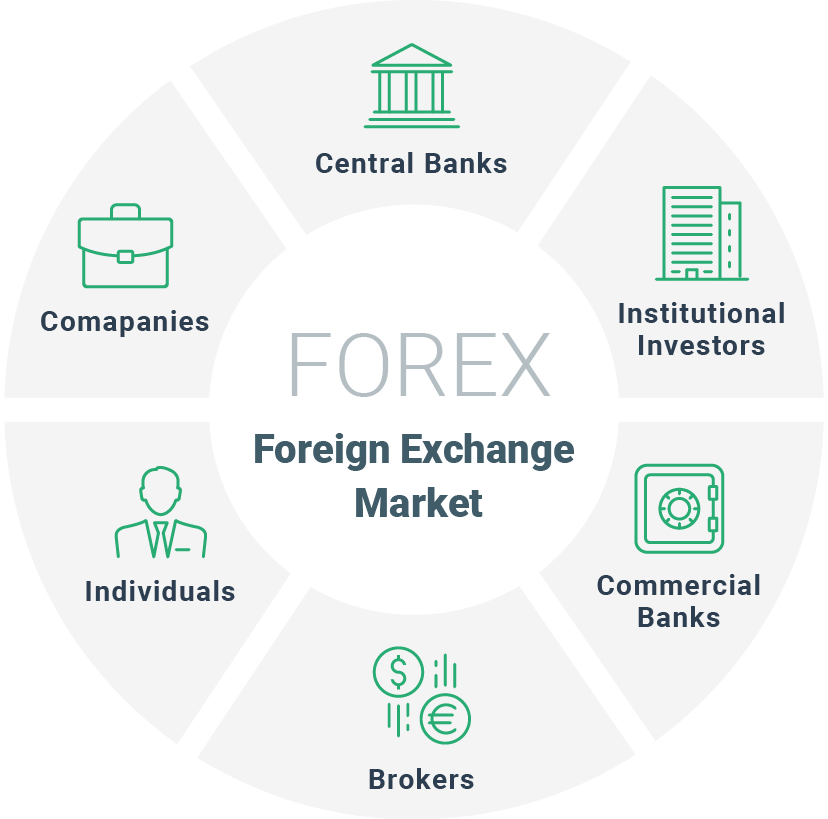

In today's info superhighway the Forex market is no longer entirely for the institutional investor. The last 10 years have seen a boost in non-institutional traders accessing the Forex market and the advantages it offers.

Everything about Top 30 Forex Brokers

International exchange trading (foreign exchange trading) is a global market for buying and offering money - Quotex. 6 trillion, it is 25 times larger than all the world's stock markets. As a result, rates alter continuously for the money that Americans are most likely to make use of.

When you sell your money, you receive the repayment in a different currency. Every traveler that has actually gotten foreign currency has done forex trading. The trader purchases a certain currency at the buy price from the market maker and markets a different currency at the marketing rate.

This is the transaction cost to the investor, which in turn is the revenue gained by the market maker. You paid this spread without realizing it when you exchanged your dollars for international money. You would certainly see it if you made the transaction, canceled your trip, and afterwards tried to exchange the currency back to bucks as soon as possible.

The Definitive Guide for Top 30 Forex Brokers

You do this when you think the money's worth will certainly fall in the future. Businesses short a money to protect themselves from threat. But shorting is extremely high-risk. If the money climbs in value, you need to acquire it from the dealership at that price. It has the exact same benefits and drawbacks as short-selling stocks.

Report this page